BEARISH COCONUT OIL MARKET IN THE FIRST HALF OF 2017

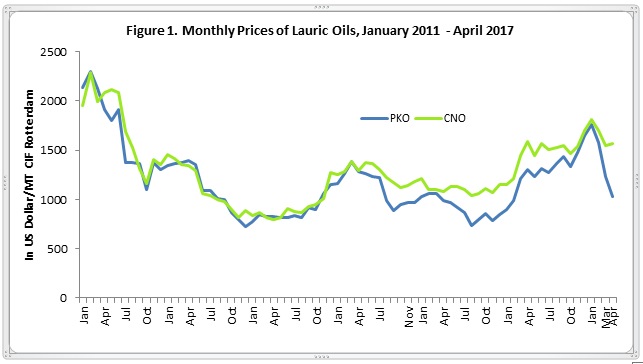

After experiencing a bullish market in 2016, coconut oil market showed an easing trend in the beginning of 2017 amid a tight global supply for the product. In January 2017, the price of coconut oil was US$1,815/MT and reduced to US$1,571/MT in April 2017. At the same time, the price of palm kernel oil dropped from US$1,760/MT in January 2017 to US$1,029/MT in April 2017. This brought about the price premium over palm kernel oil to rocket from US$55 in January 2017 to as much as US$542 in April 2017.

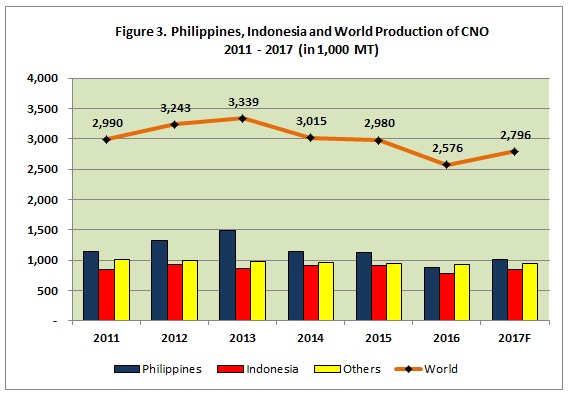

Since in international market, coconut oil plays a complementary role with palm kernel oil, the high price premium over palm kernel oil put a pressure on the price of coconut oil. This may not only point toward a downtrend in palm kernel oil but also mirrors the prevailing shortage of coconut oil supply. The supply of coconut oil suffered from insufficient production and competition for raw materials with other coconut products. UCAP estimated Philippine coconut production in 2016 declined by 9.1% to 2.052 million MT in copra terms, from year-earlier revised data at 2.258 million MT. The shortfall was attributed to the prolonged rainfall deficit due to El Niño episode during the last quarter of 2015 that extended up to the first half of 2016. The adverse effect of El Nino had also affected coconut production in Indonesia which led to lower copra production. In 2016, copra production in Indonesia is predicted to decline by 7.1%.

In India, a Coconut Development Board survey revealed production estimate for agriculture year 2016/17 at 20,789 million nuts, 6.22% lower than the previous year. The shortfall is on account of the deficient monsoon. At the same time, demands for other coconut products were increasing. Amid a drop in coconut oil exports, desiccated coconut exports from Philippine jumped by 35.6% in 2016. While in Indonesia exports of fresh coconut rocketed for more than 40% in 2016 at the expense of other coconut products including coconut oil.

The shortfall in production and strong demand for other coconut products had inevitably led to a reduction in export supplies. Global Exports of coconut oil in 2016 plunged by 15% from 2.2 million MT in 2015 to 1.9 million MT in 2016. The drop was following a negative trend since 2014 when the world export of coconut oil eased to the volume of 2.146 million MT or experienced a year-on-year decrease by 4.9% after experiencing a substantial increase in previous two years at an average annual growth rate of 10%. In 2015, the global exports of the commodity declined by 1% following a negative trend in the previous year. Philippines and Indonesia as major exporting countries of coconut oil underwent strong reductions in exports of the product. In the calendar year of 2016, total export of coconut oil from the two countries fell for more than 17% compared to the same period in 2015. Philippines’ exports of coconut oil from January to December 2016 were 726,827 MT or dropped by 14.8% compared to the same period of 2015. This export volume is the lowest since 1999. It is worth noting that in the last decade the lowest export volume of coconut oil from Philippines was in 2011 accounting for 781,411 MT. Meanwhile, exports of the commodity in 2015 were 853,152 MT or decreased by 0.4% compared to that of 2014. Meanwhile, exports of coconut oil from Indonesia plunged by 20.7% compared to the same period in 2015. The drop was following the declining trend in the previous year which was contracted by 1.6% from 771,419 MT in 2014 to 759,381 MT in 2015.

The shortage in the global production has, furthermore, restrained an increasing trend in the global demand. The import demand of coconut oil in the world market was squeezing from 2.1 million MT in 2015 to 1.9 million MT for the corresponding period in 2016. In the same period, the other lauric oil, palm kernel oil, also reduced by 9.6% to level of 2.9 million MT as opposed to 3.2 million MT. As a result, total imports of lauric oils decreased by 9.7% to a level of 3.4 million MT as against 4.8 million MT of 2015. Apart from a shortage in copra production, a wide price premium over palm kernel oil has also been prompting a pronounced shift of demand at the expense of coconut oil at least in some countries.

The shortage in the global production has, furthermore, restrained an increasing trend in the global demand. The import demand of coconut oil in the world market was squeezing from 2.1 million MT in 2015 to 1.9 million MT for the corresponding period in 2016. In the same period, the other lauric oil, palm kernel oil, also reduced by 9.6% to level of 2.9 million MT as opposed to 3.2 million MT. As a result, total imports of lauric oils decreased by 9.7% to a level of 3.4 million MT as against 4.8 million MT of 2015. Apart from a shortage in copra production, a wide price premium over palm kernel oil has also been prompting a pronounced shift of demand at the expense of coconut oil at least in some countries.

The US is one of countries where the buyers of lauric oils indicate to shift their preference at the expense of coconut oil. A decline in imports of coconut oil was observed in the US during 2016. The US imports of the oil was 0.52 million MT or shrunk by 6% compared to 0.55 million MT in the previous year. Meanwhile, imports of palm kernel oil in the same period were increasing. The oil rose from 0.31 million MT in January-December 2015 to 0.35 million MT in the same period of 2016. Hence, share of coconut oil to the US total imports of lauric oils reduced to 59% from 64% in the corresponding period of 2016.

The shift in preference of lauric oils due to a high price premium of coconut oil over palm kernel oil at the expense of coconut oil was also observed in Europe. In the period of January-Drecember 2016, share of coconut oil to the European total imports of lauric oils was 47.2% which was 3% lower than its share in 2015 for the same period. Shipments of coconut oil to Europe were 0.07 million MT which was shrunk by 11.3% opposed to that of last year. In total, imports of lauric oils eased by 5.2% following a shortfall in supply of the oil.

Unlike in the US and Europe, the cross-price substitution effect of the two oils did not appear in China. The share of coconut oil to total imports of lauric oils in 2016 remained at 19% the same as that of last year. The demand of the oil also reduced to 0.13 million MT from 0.14 million MT in 2015 or shrunk by 2.6%. The decline in demand was also witnessed for palm kernel oil. The oil dropped to 0.55 million MT in 2016. Hence, the total imports of lauric oils to China shrunk by 9.8% for the said period.

Unlike in the US and Europe, the cross-price substitution effect of the two oils did not appear in China. The share of coconut oil to total imports of lauric oils in 2016 remained at 19% the same as that of last year. The demand of the oil also reduced to 0.13 million MT from 0.14 million MT in 2015 or shrunk by 2.6%. The decline in demand was also witnessed for palm kernel oil. The oil dropped to 0.55 million MT in 2016. Hence, the total imports of lauric oils to China shrunk by 9.8% for the said period.

The reverse trend of global coconut oil exports is expected to take place in 2017 as copra production is expected to improve though in limited pace following the recovery in coconut production. UCAP projected Philippine coconut production to recover 9.3% to 2.244 million MT. The recovery is expected to happen as rainfall pattern revealed recovery from below normal status to above normal in many coconut areas especially in the last quarter. Hence the expectation that the second semester harvest will be better than the first semester. As for Indonesia, coconut production is estimated to be stagnant in 2017 amid the recovery of rainfall pattern. Ministry of Agriculture estimated that coconut production will insignificantly decline by 0.7% compared to the last year production.

A subdued recovery in global supply is most likely preventing the price from a deep fall amid a very high price premium over palm kernel oil. In the second half of 2017, price of coconut oil is expected to be strong or at least maintain its current level.

A subdued recovery in global supply is most likely preventing the price from a deep fall amid a very high price premium over palm kernel oil. In the second half of 2017, price of coconut oil is expected to be strong or at least maintain its current level.