MARKET REVIEW OF DESSICATED COCONUT

February 2018

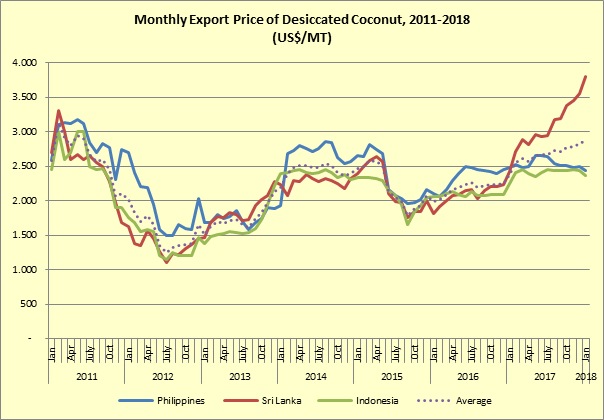

Price of DC in 2017 in main producing countries, Philippines and Indonesia, was relatively stable at annual average of US$2,537/MT and US$2,409/MT respectively. Until the second quarter of 2017, price of DC showed an increasing trend and maintained its level at around US$2,500/MT in the third quarter. The trend was following an improving trend in 2016 after experiencing a sluggish market in 2015. Price of DC in Philippines went up to US$2,655/MT in June 2017 and eased to US$2,493/MT in December 2017. Indonesia experienced almost an identical trend with Philippines where the price of DC rose to US$2,447 in July 2017 and lessened to US$2,367/MT in December 2017. A prolonged increase prevailed in Sri Lanka when the price soared by 47% from January to December 2017. The increase has put prices of Sri Lankan DC higher than those of Philippines and Indonesia which has made Sri Lankan DC less competitive in global market. Higher price of raw materials, coconut, in Sri Lanka has inevitably pushed DC processor to adjust their prices. In December 2017, domestic price of coconut in Sri Lanka was twice as much as that of domestic prices in Indonesia and Philippines.

In 2017, Philippines has maintained its increasing trend of desiccated coconut (DC) export since last year. The official figure from the Philippines Statistics Authority showed that the export of DC from January to November 2017 was 108,561 MT which was 33.7% higher than previous year’s volume for the same period. The export volume was even the highest since 2015. After experiencing a shortage in supply of raw material due to el nino in 2015 worsened by a series of typhoons, Philippines’ DC indicated a sign to recover following an improvement in coconut production as favorable weather came. This has enabled Philippines DC manufacturers to fulfill the global demands in international market. The ongoing high premium of Sri Lankan DC prices has also, to some extent, put Philippine’s DC more competitive in the global market. In international market, America and Europe were still major destinations for DC from the Philippines accounting for more than 82% of the total export. USA was the main destination for Philippines DC in America which absorbed 32,095 MT or 30% of the total export. In Europe, Netherlands was the main hub receiving 14% of Philippines DC. Meanwhile from Asian countries, China, Korea and Malaysia were amongst the largest importing countries of DC from the Philippines.

Like Philippines, Indonesia’s export volume of the product increased after experiencing a decline in the last three years. In the period of January-December 2017, BPS-Statistics Indonesia recorded that export volume of DC from Indonesia during the period was 98,038 MT. This was higher by 23.7% compared to the volume of the same period in previous year. The export level was even higher than that of 2014’s volume which was 86,797 MT. An upturn in raw material supply with a lower price compared to other competitors coupled with processing recovery have given a positive signal for Indonesian DC processors to boost their export. It is worth noting that export volume of DC from Indonesia declined from 86,797 MT in 2014 to 85.715 MT in 2015 and again dropped to 79,224 MT in 2016. The decrease was mainly due to a shortage in raw materials caused by unfavorable weather and competition with other coconut products.

Asia and Europe was still the main market for DC from Indonesia. 49.2% out of 98,038 MT desiccated coconut from Indonesia was shipped to Asian countries. Singapore is the main hub for DC from Indonesia. Singapore received 27% of all exported DC from Indonesia. China, Iran, Thailand, UAE and Malaysia were the other major importing countries from Asia. Europe was the second largest market for DC from Indonesia in the period. It absorbed 32.5% of Indonesia’s DC export. Germany, Russia, Poland, Netherlands, Turkey and UK are the main destinations. The third largest market was America. Its share of Indonesia’s DC market was 10%. Amongst American countries, Brazil was recorded as the largest importing country. The country imported 5,665 MT of Indonesian DC constituting 5.8% of the total export.

Unlike Philippines and Indonesia, export of DC from Sri Lanka showed an easing trend in 2017. In the period of January-December 2017, export volume of DC from Sri Lanka was 29,418 MT or dropped by 40% compared to last year’s volume for the same period. Higher price of the product caused by high price of raw materials has negatively affected global demand. Nevertheless, Sri Lanka was still a key player for DC in international market. Sri Lanka has gradually grown to be a competitor for Philippines and Indonesia as main producing country for DC. In 2016, export volume of DC from Sri Lanka recorded a notable growth of 36% compared to the export volume of the previous year.

Europe and the Middle East are traditional market for DC from Sri Lanka. In 2017, Middle East and European countries imported 8,738 MT and 7,722 MT of DC from Sri Lanka respectively. The imports of the two regions amounted to more than 56% of the Sri Lanka’s total export of DC. American continent has appeared to become an important destination for Sri Lankan DC. The continent absorbed 28% of Sri Lanka’s total export in the period. USA was the main importing country demanding for 5,233 MT or 17.8% of the total export.