MARKET REVIEW OF COIR

March 2017

Coir industry keeps showing a positive growth in global market especially for value added products. Currently global trade of coir fiber and its value added products such as yarn, matting, rugs and carpet as well as geo textile is estimated worth US$ 0.9 billion. Approximately more than 70% of its total exports are sent from India, Sri Lanka and Indonesia as the main producers, and the rest are shared by Thailand, Philippines and Malaysia. The strength of India in its domestic demand was well combined with the growth of its export which was only 1% of the world export in 1996, and increased to 11% in 2002 and then doubled to 25% in 2013. The latest figure shows that its export volume increased by more than 26% in 2016. While in the same period, Sri Lanka’s export increased by 18.7% in value which was dominated by finished products such as fibre pith, moulded coir products and coir twine. India and Sri Lanka emphasize more on value added products. Meanwhile, China is still a major importing country for coir products as its current share in the global market is more than 50% of the world import even though it currently faces a challenge from a slowdown in Chinese economy.

Exports of coir products from India continue to grow as the global market for coir and coir products is improving. The latest data from Coir Board of India show that in the period of April - July 2016, a total quantity of 269,757 MT of coir and coir products were exported from India globally. The export valued at Rs. 67,399 lakhs or equal to US$ 10.1 million. Such export revenue increased by 20.6% from the previous year at US$ 8.4 million. The revenue might still be improving due to a growing demand from importing countries, such as China and USA for coir and coir products from India.

India exports 14 coir product categories to the world market. These include semi finished products such as coir yarns, loom mats and mattings, and rubberized coir to finished products like geo-textiles, coir rugs and carpets. Exports of coir products from India were still dominated by coir pith and coir fiber. In the period of April until July 2016, the two coir products constituted for 89% of the total export volume of coir products. In the period, the two main products were increasing which brought the total exports of coir products from India to grow. Coir pith and coir fibre rose by 35.4% and 22.1% respectively. Coir geo textiles recorded the highest export growth accounting for 38.6% in volume and 51% in value. USA, China, Netherland, South Korea, and UK were the main destination of coir pith from India with the shares of 26.2%, 24.3%, 8.4%, 5.2%, and 4.8% respectively.

Meanwhile, Japan is still a major importer of Sri Lanka’s coir products. Japan’s import of coir products was dominated by coco pith which was mostly used as agriculture planting media, fertilizer, animal feed and sometimes bedding for the animal pens. In the period of January- December 2016 Japan imported 47,212 tons or 25.3% of the Sri Lanka’s total export of coco pith at 186,820 tons. Coco pith contributed the highest revenue of Sri Lanka coir products which accounted for 35.3% of the total export. Other major markets of Sri Lanka coco pith included South Korea, Mexico, China, USA, UK, Iran, and Spain. They imported coco pith ranging from 19,698 tons to 6,719 tons during the period. The combined import volume of coco pith from those countries was 77,376 tons or 41.4% of Sri Lanka’s total export of coco pith. Compared to the previous year, export volume of coco pith demonstrated a positive growth of 10%. Furthermore, in the same period, moulded coir products was the Sri Lankan coir products that showed the highest increase in volume compared to the same period in the previous year. The products recorded 40% increase in volume from 49,448 MT in 2015 to 69,412 MT in 2016.

Unlike India and Sri Lanka, exports of coir products from Indonesia were dominated by an unfinished coir product, coir fiber. Export of coir fiber from Indonesia in the period of January-December 2016 was 30,153 MT, valued US$ 7.4 million. The total export volume declined by 15% compared to the volume of previous year for the same period. China was the major importing country for coir fiber from Indonesia. China absorbed 25,509 MT or 84.6% of Indonesia’s export of coir fiber. Other destinations for coir fibre from Indonesia were Japan, South Korea, Malaysia, and Singapore. The export of raw coir fiber in bales was almost the only coconut coir products from Indonesia shipped to the global market in the observed period. Exports of other coir products were significantly low both in volume and value.

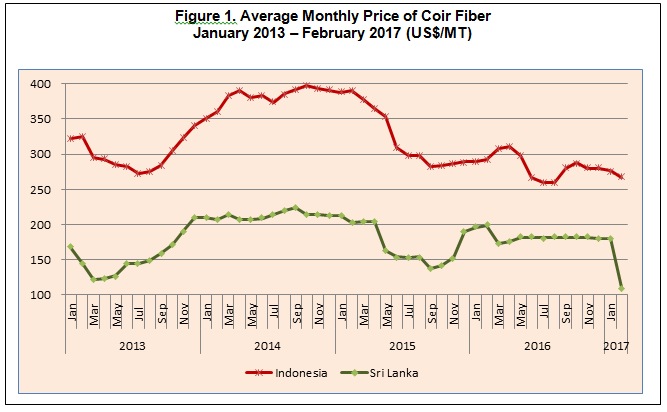

Price of coir fibre showed a decreasing trend in the last quarter of 2016 and remained weak in the beginning of 2017. In Sri Lanka, the average price of raw fibre dropped to US$ 110/MT in February 2017 after a stagnant trend in the second half of 2016. While the price of coir fibre in Indonesia started to decline in the last quarter of 2016 and reached US$ 268/MT in February 2017. A slowdown in Chinese economy as a major importing country of raw fibre and an increasing demand of value added products brought about a decreasing trend in the demand of raw fibre which led to a lower price.