MARKET REVIEW FOR COCONUT OIL

September 2017

Global supply of coconut oil showed an improving trend after suffering from a shortage in copra production. Philippines as a major exporting country of coconut oil boosted its exports of the product. Meanwhile, Indonesia is still struggling to accumulate its copra production. In the period of January-May 2017, the total export of coconut oil from the two countries went up for more than 29% compared to the same period in 2016. The increase was a positive signal to the global market since coconut oil experienced a decrease in the last three consecutive years. In 2016, the world export of coconut oil dropped by 17% following an easing trend in 2015 when the global exports of the commodity declined by 1%. In 2014, the world exports of coconut oil experienced a year-on-year decrease by 4.9%.

Philippines’ export of coconut oil from January to May 2017 was 413,529 MT which was 86% higher than the last year’s export volume for the same period. This shows a reverse trend of CNO export from the Philippines after experiencing a dull market in last three years. In the last three years, export volume of CNO from Philippines fell on annual average of 13% and the 2016’s export volume was recorded as the lowest since 1999. Europe, and USA were still the main destinations of coconut oil from the Philippines following by Japan. Europe absorbed more than 60% of the Philippines’ total export of the commodity in the said period, of which about 30.2% went to USA. 4.3% of the commodity was shipped to Japan and 2.7% was sent to China. The reverse trend in export is following a recovery in coconut production leading to a higher copra production. A favorable weather since the end of 2016 attributed to the increase in coconut production.

From January to June 2017, Indonesia exported 264,699 MT of CNO to the global market. The export was lower by 20% compared to the last year’s volume for the same period. The decrease indicated Indonesian CNO manufacturers still face problems in sourcing raw materials. Though coconut production has shown a recovery trend due to good weather, competition for raw materials with other coconut products remains as increasing demand for other products has put a pressure on copra production. If the exports do not improve in the coming months, Indonesia will experience a decline in three consecutive years since 2015. In 2015, exports of coconut oil from Indonesia contracted by 1.6% and in 2016 the export plunged by 20.7%. Indonesia’s coconut oil was mainly shipped to United States, China, Netherlands, Malaysia, and South Korea which have been considered as traditional markets for coconut oil from Indonesia. The US has been the largest importing country for coconut oil from Indonesia for years. In the period, 27% export of coconut oil from Indonesia was sent to the US. Meanwhile, the export percentage of coconut oil to China, Netherlands, Malaysia and South Korea was 19%, 17%, 14% and 9% respectively.

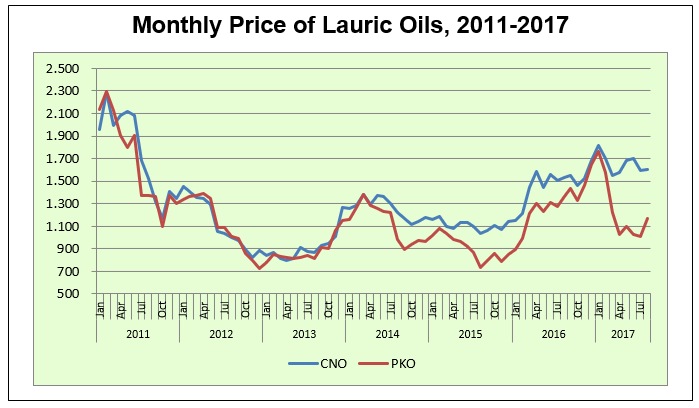

As global production is improving, global demand is expected to increase in 2017. The world imports of coconut oil in 2017 is expected to slightly rise by 2%. It is worth noting that the shortage in the global production in 2016 has restrained an increasing trend in the global demand. The import demand of coconut oil in the world market was squeezing from 1.97 million MT in 2015 to 1.61 million MT for the corresponding period in 2016. In the same period, the other lauric oil, palm kernel oil, also went down by 5% to the level of 3.29 million MT as opposed to 3.05 million MT. As a result, total imports of lauric oils decreased by 11.4% to a level of 4.66 million MT as against 5.26 million MT of 2015. After experiencing a bullish market in 2016, coconut oil market showed an easing trend in the beginning of 2017. In January 2017, the price of coconut oil was US$1,815/MT and was reduced to US$1,580/MT in April 2017 and stayed at the level of US$1,600/MT till August 2017. At the same time, the price of palm kernel oil dropped from US$1,760/MT in January 2017 to US$1,029/MT in April 2017 and further declined to US$1,007/MT in July 2017. This brought about the price premium over palm kernel oil to rocket from US$55 in January 2017 to as much as US$584 in July 2017. In August 2017 the premium was lessened to US$439 when the price of palm kernel oil rose to US$1,165/MT. Price pressure on coconut oil is pointing to a recovery in copra production leading to an easing of supply shortage of the product and also the high price premium over palm kernel oil.