MARKET REVIEW OF COCONUT OIL

May 2018

Production deficiency of coconut puts a pressure on copra production. The Oil World indicates that the global copra production in 2017 is expected to decrease by 4.1% as opposed to the previous year’s production at 4.12 million tons. Only the Philippines is projected to have a good production of copra following a favorable weather. Copra production in Philippines is estimated to increase by 7% to the level of 1.37 million tons this year. Meanwhile Indonesia is expected to have lower copra production of 1.18 million tons compared to 1.28 million ton in the previous year. Copra production has stayed behind potential in recent years, partly as a result of senile palms worsened by typhoon damage and diseases but also indicating rising demand for coconuts for other uses. Export of desiccated coconut from Philippines leveled up by 38% to 100,818 tons during the period of January-October 2017. Exports of desiccated coconut from Indonesia rose as well to 78,538 or increased by 20% compared to the same period last year. Export of fresh coconut even rocketed from 392,997 tons in January - October 2016 to 720,961 tons for the same period in 2017.

Amid a tight copra production, global export of coconut oil in 2017 is expected to maintain its level at 1.66 million tons and hold back the previous negative trends. Current figures show that Philippines’ export of coconut oil in 2017 leaped by 35% from 571,440 MT to 773,192 in the period of January-October 2017. The reverse trend in export volume is following a recovery in coconut production leading to a higher copra production. A favorable weather since the end of 2016 attributed to the increase in coconut production. Meanwhile in the period of January-October 2017 Indonesian export of the product was 415,577 MT or declined for more than 15% compared to 492,715 MT for the same period last year. Insufficient coconut production worsened by competition for raw material with other coconut products restrained recovery of copra production in Indonesia.

In the period of January-October 2017, Europe and USA were still the main destinations of coconut oil from the Philippines following by Japan. Europe absorbed for more than 57% of the Philippines’ total export of the commodity in the said period, and about 31% went to USA. 4.6% of the commodity was shipped to China and 4.5% was sent to Japan. Meanwhile, Indonesia’s coconut oil was mainly shipped to United States, China, Netherlands, Malaysia, and South Korea which have been considered as traditional markets for coconut oil from Indonesia. The US has been the largest importing country for coconut oil from Indonesia for years. In the period, 27.5% export of coconut oil from Indonesia was sent to the US. Meanwhile, export of coconut oil to China, Netherlands, Malaysia and South Korea was 19.7%, 16.2%, 14.3% and 8.7% respectively.

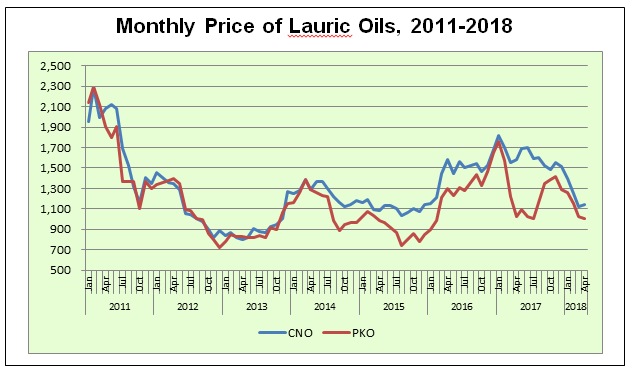

The import demand of coconut oil, on the other hand, is expected to grow from 1.62 million MT in 2016 to 1.69 million MT in 2017 and forecasted to further strengthen in 2018. At the same time import of palm kernel oil is, similarly, estimated to scale up from 3.06 million MT to 3.19 million MT. As a result, total imports of lauric oils decreased by 9.7% to a level of 3.4 million MT as against 4.8 million MT of 2015.