MARKET REVIEW OF COCONUT OIL

January 2017

Following the declining trend in the last two years as an effect of unfavorable weather, copra production decreased in 2016. Global copra production in 2016 dropped for more than 9%. The lagging effect of severe dryness in 2015 is also expected to limit the recovery of copra yields in 2017. Competition for raw materials with other coconut products has also put a pressure on production of coconut oil and meal as demand for other coconut products grows.

The shortage in the global production has, furthermore, restrained an increasing trend in the global demand. The import demand of coconut oil in the world market was dwindling from 1.01 million MT in January-June 2015 to 0.79 million MT for the corresponding period in 2016. In the same period, the other lauric oil, palm kernel oil, also fell off by 5% to level of 1.63 million MT as opposed to 1.55 million MT. As a result, total imports of lauric oils decreased by 11.4% to a level of 2.34 million MT as against 2.64 million MT of last year for the same period.

Moreover, the drop in production has also curbed export supplies. Philippines and Indonesia as major exporting countries of coconut oil experienced a sharp decline in exports of the product. Until the third quarter of 2016, total export of coconut oil from the two countries fell for more than 20% compared to the same period in 2015. The drop was following a negative trend since 2014 when the world export of coconut oil eased to the volume of 2.146 million MT or experienced a year-on-year decrease by 4.9% after experiencing a substantial increase in previous two years at an average annual growth rate of 10%. In 2015, the global exports of the commodity declined by 1% following a negative trend in the previous year. The reverse trend of global CNO exports is expected to take place in 2017 as copra production is expected to improve though in limited pace.

Philippines’ exports of coconut oil from January to September 2016 were 474,846 MT or decreased by 27.5% compared to the same period of 2015. It is expected that exports of the products from Philippines in 2016 will experience a significant drop and most probably be the lowest in the last five years. It is worth noting that in the last decade the lowest export volume of coconut oil from Philippines was in 2011 accounting for 781.411 MT. Meanwhile, exports of the commodity in 2015 were 853,152 MT or decreased by 0.4% compared to that of 2014. Europe, USA, and Japan were still the main destinations of coconut oil from the Philippines followed by China. Europe absorbed for more than 58% of the Philippines’ total export of the commodity in the said period, and about 32% went to USA. 5% of the commodity shipped to Japan and 2% sent to China. Apart from the drop in the domestic copra production, Philippines’ export of coconut oil significantly declined since the industry also faced difficulties in finding new source of raw materials as other main source countries such as Indonesia and Papua New Guinea faced the same problems due to a lagging effect of unfavorable weather in 2015.

Indonesia, as the second largest exporting country, has also been affected by the drop in copra supply. From January to October 2016, exports of coconut oil from Indonesia dropped by 22.4% compared to the same period in 2015. The drop was following the declining trend in the previous year which was contracted by 1.6% from 771,419 MT in 2014 to 759,381 MT in 2015. The decline was mainly due to a shortage in raw materials not only due to a long drought but also due to competition for raw materials with other coconut products as demand for other products including fresh coconut strengthened. Indonesia’s coconut oil was mainly shipped to United States, China, Netherlands, Malaysia, and South Korea which have been considered as traditional markets for coconut oil from Indonesia. The US has been the largest importing country for coconut oil from Indonesia for years. In the period, 29.7% export of coconut oil from Indonesia was sent to the US. Meanwhile, export of coconut oil to China, Netherlands, Malaysia and South Korea was 19.3%, 14.8%, 13.2% and 8.8% respectively.

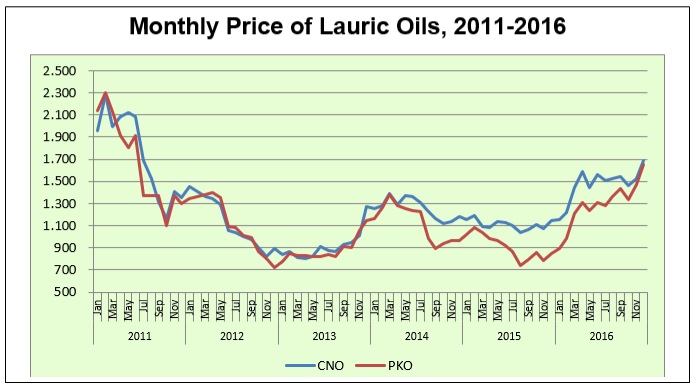

After experiencing a bearish market in 2015, coconut oil market showed a reverse trend in 2016. An expected low copra production in main producing countries such as Philippines and Indonesia has driven coconut oil prices to increase. Price of coconut oil in December 2015 was US$/MT 1,150 in Rotterdam and increased by 46.4% to US$/MT 1,684 in December 2016. In international market, coconut oil plays a complementary role with palm kernel oil. Thus, the increase in price of coconut oil has inevitably brought the price of palm kernel oil to move up and vice versa. Since the price of coconut oil increased, it has pulled upward palm kernel oil prices. Price of palm kernel oil in December 2015 was US$/MT 832 and jumped to US$/MT 1,650 in December 2016 or improved by 98.3%. The significant increase in price of palm kernel oil has been narrowing the current unusually large price discount of palm kernel oil vis-à-vis coconut oil. The price premium of coconut oil over palm kernel oil in December 2015 was US$/MT 300 and narrowed down to only US$/MT 34 in December 2016.

It is expected that price of coconut oil will remain strong at least until the first quarter of 2017 as production of the product will hardly improve due to a limited copra supply. As price of coconut remain strong, price of palm kernel oil will inevitably move up to narrow its price discount against coconut oil.