- Home

- Statistics

- Market Review

Market Review Coconut Oil

September 2021

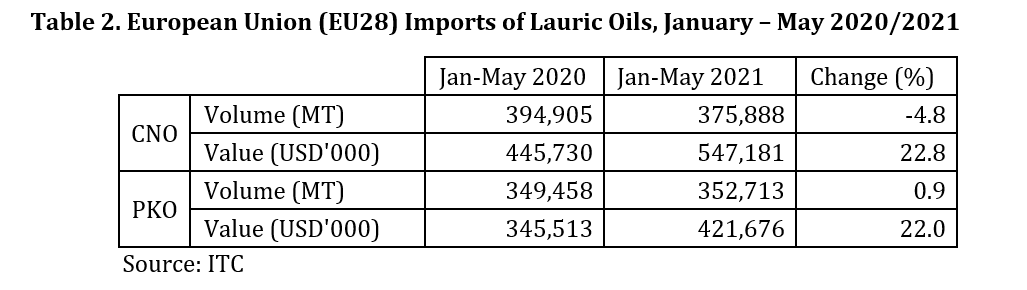

Prices of lauric oils are expected to ease following foreseeable higher production during last quarter of 2021 assuming normal weather conditions and controllable COVID pandemic in producing countries such Indonesia, Malaysia, and Philippines. The current high prices of coconut oil and palm kernel oil are not maintainable. Price of the lauric oils have showed a downward trend since the third quarter of 2021. Price of coconut oil in May 2021 was US$1,684/MT, the highest since June 2018. The price was slowing down in the next three months reaching US$1,486/MT in August 2021. Similarly, Price of palm kernel oil was weakening from US$1,530/MT in May 2021 to US$1,333/MT in August 2021. The price pressure is expected to prolong until the end of the year anticipating increase in production of the oils.

Figure 1. Price of Lauric Oils, January 2011 – August 2021, (USD/MT)

Source: ICC

Global production of coconut oil is expected to improve in the last quarter of 2021 assuming good weather condition and controllable COVID pandemic especially in Indonesia and Philippines. However, overall production in 2021 is projected to insignificantly strengthen. Likewise, international trade of the oil is most likely to remain weak. Global exports of the oil are forecasted to slow down by more than 3% this year.

A report from Philippine Statistics Authority indicated that during the period of January-June 2021, coconut oil exports from Philippines declined by 34% to 353,723 metric tons from 474,153 metric tons in January-June 2020 reflecting lower production of the oil in the country. The exports are expected to improve in the second half of 2021 following higher production and demand, especially from Europe and USA.

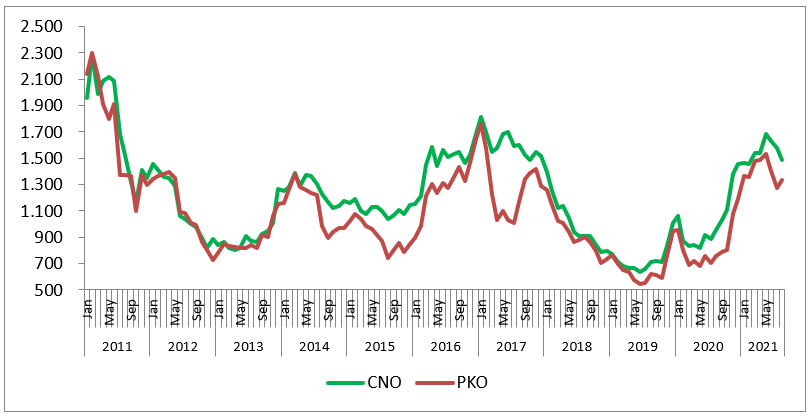

Figure 2. Export Destinations of Philippines’ Coconut Oil, January-June 2021

Source: UCAP

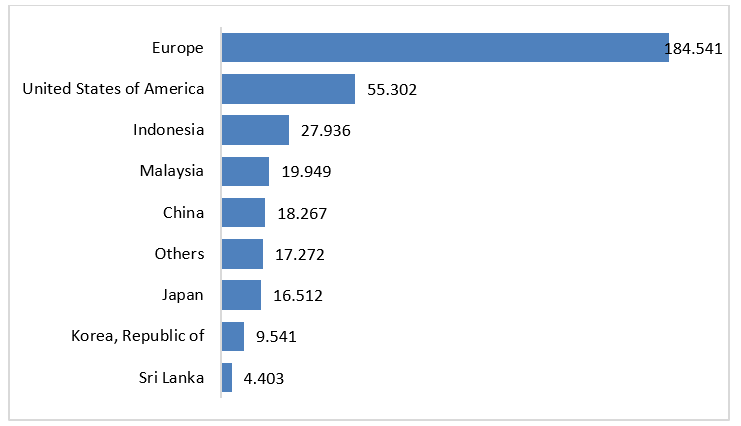

Meanwhile, export coconut oil from Indonesia is recorded a higher volume during the first half of 2021. During the period, Indonesia shipped 297,445 MT coconut oil to global market. The export was 4.8% higher as opposed to the previous year’s volume. Indonesia has played complementary role in the global market as Philippines experienced a distraction in production. Major markets for Indonesian coconut oil were Malaysia, United States, China, and Netherlands. Export volume to these four countries constituted for more than 66% of the total export.

Figure 3. Export of coconut oil from Indonesia, January-June 2020/2021

Source: BPS-Statistics Indonesia

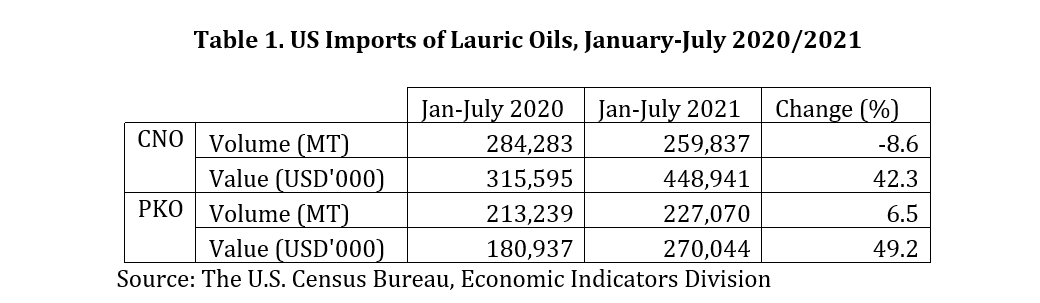

High premium price of coconut oil over palm kernel oil made the latter more attractive for buyers. Shift of demand of lauric oils at the expense of coconut oil was inevitably and had been observed since last year. During January-July 2021, US import of coconut oil was recorded a decrease of 8.6% to 259,837 MT. Meanwhile, import of palm kernel oil rose by 6.5% leading to a slight decrease in total import of the lauric oils. It worth noted that in 2020 US import of coconut oil decreased by 2.4%. At the same time, import of palm kernel oil jumped by 11.5%.

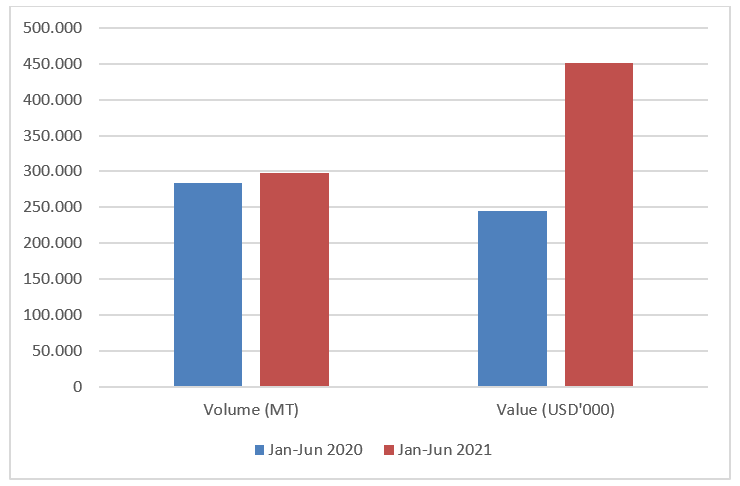

A weak demand of lauric oils was also persistent in Europe continent. During period of January-May 2021, imports of the oils by European countries was 710,601 which was 2% lower than the volume a year earlier. Import of coconut oil contributed to the lower import of the oils. Coconut oil import by European countries dropped by 4.8% during the period of January-May 2021. Meanwhile, imports of palm kernel oil slightly increased to 352,713 MT. In 2020, 1.7 million MT of lauric oils was shipped to European countries which was 1.6% lower than that of the import volume a year earlier. However, demand of lauric oil is expected to recover in 2022 following global economic recovery and higher production of the oils.