- Home

- Statistics

- Market Review

Market Review of Coconut Fiber

March 2023

Coir fibre is a versatile natural product made from the fibrous outer layer of coconut husks. It is used in a wide range of applications, including agriculture, horticulture, and home furnishings. In recent years, the coir market has experienced fluctuations in prices due to various factors.

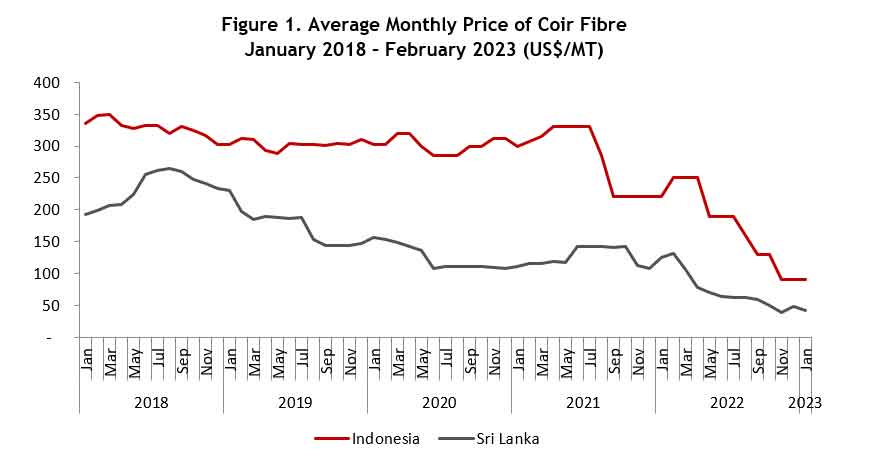

During 2022, coir fibre experienced a bearish market, with prices declining significantly over the course of the year. For example, in Indonesia, the price of coir fibre dropped from US$250/MT in February 2022 to only US$90/MT in February 2023. Similarly, in other markets, the price of coir fibre decreased by as much as 68% within twelve months, from US$131/MT in February 2022 to US$42/MT in February 2023.

One of the major factors contributing to this decline in prices was the industry's heavy reliance on the Chinese market for the raw material. With the outbreak of the Covid-19 pandemic, the Chinese market was largely closed, disrupting the supply chain for coir fibre and causing a significant reduction in demand. This put pressure on prices, leading to the deep discounts seen in the market.

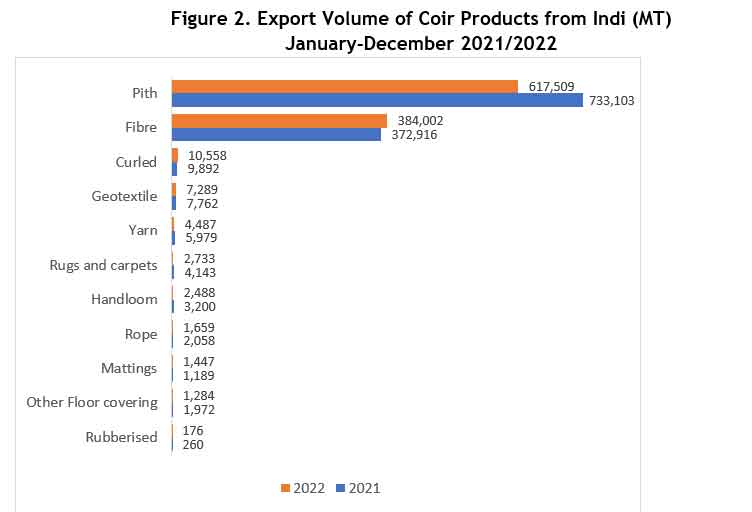

Despite the challenges faced by the coir market during 2022, India, Indonesia, and Sri Lanka remained major exporters of coir-based products. According to the latest report from the Ministry of Commerce and Industry of India, during January-December 2022, a total volume of 1.04 million tons of coir and coir products were shipped from India to the global market, creating export revenue of US$355.92 million. However, the volume dipped by 9.6% compared to the same period in 2021. Coir pith and fibre were still the main products sent globally, accounting for more than 97% of the total volume and contributed 87.5% of the total export revenue in 2022. The major destinations for Indian coir products were China, the USA, the Netherlands, South Korea, and Spain, which covered 75% of global demand.

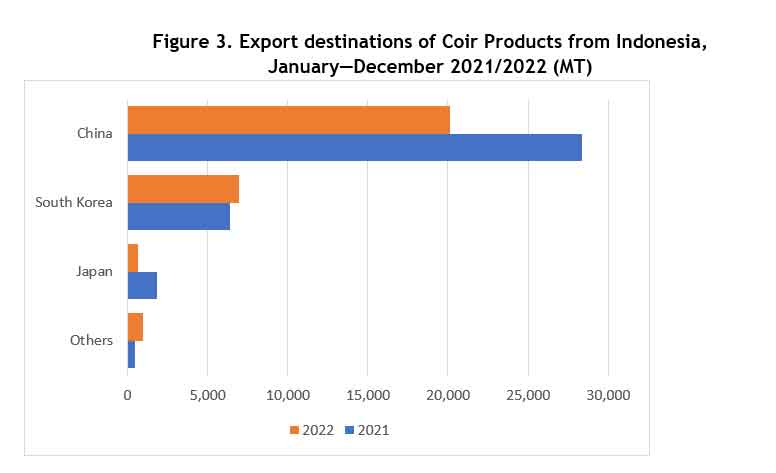

In Indonesia, export volume of coir-based products during January-December 2022 was 28,696 MT, which was lower than the previous year's volume of 37,101 MT, reflecting a decrease of 23%. In terms of value, exports went down by 37%, reflecting lower prices of the products. China, South Korea, and Japan remained major destinations for coir from Indonesia, accounting for more than 97% of coir products exported. Coir fibre and coir pith were the main products sent from Indonesia to the global market.

Similarly, in Sri Lanka, export revenue of coir-based products declined during 2022. It dipped by 7% from US$242.62 million in 2021 to US$226.8 million in 2022. Moulded coir products used for horticulture were the country’s highest contributor to the export revenue from coir-based products during the last few years, including in 2022, valued at US$164.19 million, accounting for more than 72% of the total export value. However, the export value was 3.5% lower compared to the previous year. Other products that significantly contributed to the export earnings were mattress fibre, twisted fibre, and coir pith. The main export destinations for moulded coir products used for horticulture from Sri Lanka included China, Japan, Morocco, Turkiye, and the UK.

The industry needs to diversify its markets to increase demand in both domestic and international markets. The domestic market for coir-based products is relatively small and unexplored, but it has great potential for growth. The industry could focus on promoting the use of coir products in domestic markets through education and marketing campaigns.

Another strategy could be to focus on expanding the coir market in countries with high demand for eco-friendly and sustainable products. For instance, the European Union is a significant market for sustainable products, and coir-based products could appeal to consumers in this region. Similarly, there is growing demand for sustainable products in North America, and the coir industry could explore opportunities to expand into this market.

Finally, the coir industry needs to develop more efficient and sustainable production methods to reduce its environmental impact. This could include using renewable energy sources, reducing water consumption, and improving waste management practices.