- Home

- Statistics

- Market Review

Market Review of Coconut Oil

September 2022

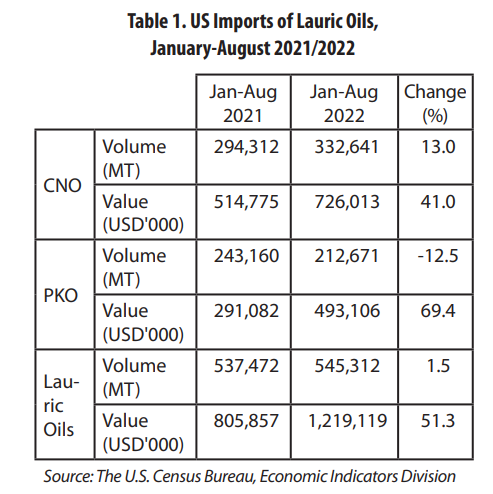

Amid global uncertainty due to pandemic and Russia-Ukraine war, global trade of lauric oils showed a turn back trend in 2022. Lower prices and international cargo recovery have triggered an increase in shipments of the oils. Demand of the oils from main importing regions such as USA and European Union is reported to go up during the first half of 2022. During January-August 2022, US import of lauric oils was recorded a significant upsurge to level of 545,312 MT meaning an increase of 1.5% compared to the volume a year earlier. The upsurge attributed to the increase in imports of coconut oil. Demand for the oil by US market went up by 13% during January-August 2022 compared to the volume a year earlier. Meanwhile, import volume of palm kernel oil dropped by 12.5% from 243,160 MT to 212,671 MT during January-August 2022.

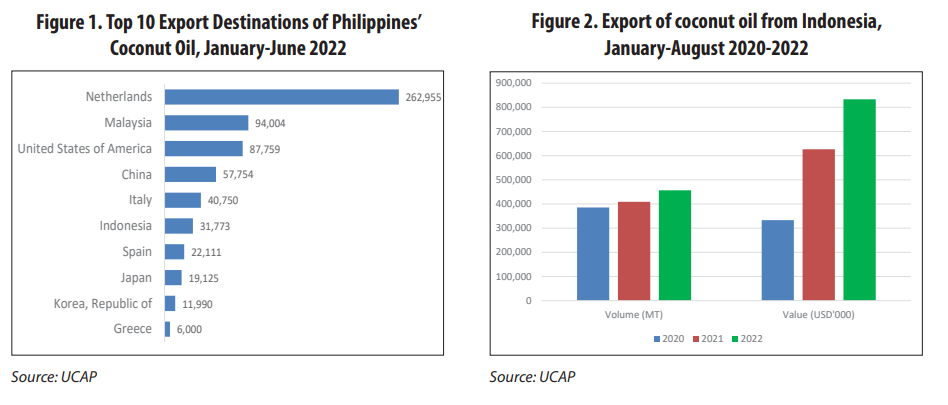

In the supply side, Philippines unexpectedly managed to improve their export of the products. Philippine Statistics Authority reported that during the period of JanuaryJune 2022, coconut oil exports from Philippines went up to 643,030 metric tons from 353,723 metric tons in January-June 2021. Better international shipments and lower prices have enabled oil producers in the country to release their oil stocks which have been abundant in the last two years. Shipments of the oil to main destinations such as European countries and USA increased notably. Philippines export of the oil to European countries went up to 334,777 tons in January-June 2022 from 184,541 metric tons in January-June 2021. At the same time, export to US market hiked from 87,759 tons to 55,302 tons.

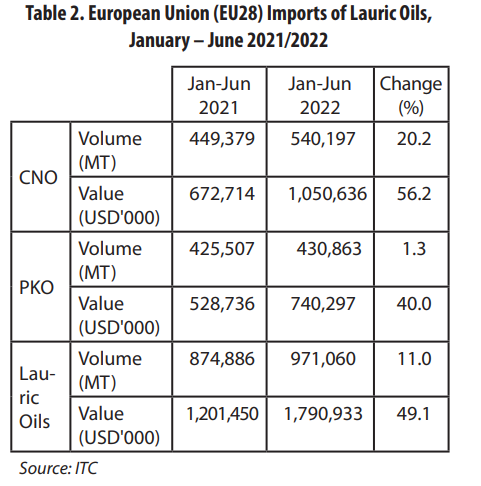

Similarly, shipments of the oils to European market in the first half of 2022 showed increasing trend. During period of January-June 2022, imports of lauric oils by European countries was 971,060 which was 11% higher than the volume a year earlier. Import of coconut oil contributed to the higher import of the oils. Import volume of the oil jumped by 20% during the period. Likewise, palm kernel oil import by European countries slightly rose by 1% during the period.

In the supply side, Philippines unexpectedly managed to improve their export of the products. Philippine Statistics Authority reported that during the period of JanuaryJune 2022, coconut oil exports from Philippines went up to 643,030 metric tons from 353,723 metric tons in January-June 2021. Better international shipments and lower prices have enabled oil producers in the country to release their oil stocks which have been abundant in the last two years. Shipments of the oil to main destinations such as European countries and USA increased notably. Philippines export of the oil to European countries went up to 334,777 tons in January-June 2022 from 184,541 metric tons in January-June 2021. At the same time, export to US market hiked from 87,759 tons to 55,302 tons.

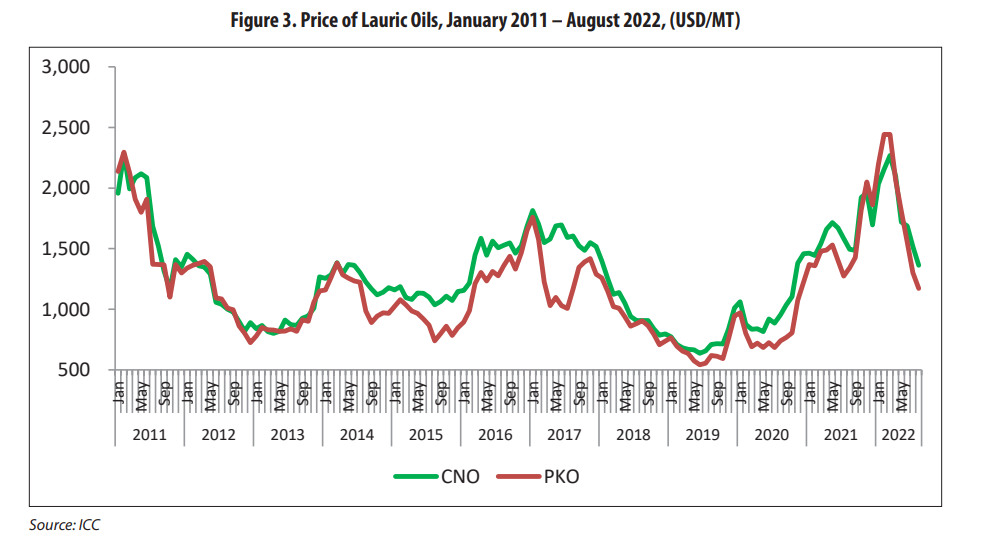

Likewise, following the positive trend in 2021, Indonesia recorded a higher export volume of coconut oil during January-August 2022. During the period, Indonesia shipped 456,674 MT coconut oil to global market. The export was 12% higher as opposed to the previous year’s volume. The export earnings jumped from US$ 626.7 million to US$ 832.9 million or an upsurge of 33% reflecting a higher volume and price of the oil. Major markets for Indonesian coconut oil were United States, Malaysia, China, and Netherlands. Price pressure on lauric oils is persisting until third quarter of 2022. Price of oils dropped of more than 20%. Price of coconut oil depreciated by 20% and price of palm kernel oil dropped by 37% during the JanuaryAugust 2022. Abundant stocks of the oils and expected lower demand have brought about the price to lower. Price of the oils is expected to remain weak until end of the CY 2022. However, the lower prices are expected to revive demand of the oils.